It’s no longer a buzzword or a passing trend – cryptocurrency is a financial revolution changing the way the world thinks about money, investment and commerce. And for business leaders – knowing the ins and outs of crypto trading means more than staying ahead of the curve – it means planning for the future-finding new revenue streams and adjusting to a rapidly changing financial landscape. Let’s have a look at how to get into crypto trading to know much about.

Why Business Leaders Can Not Ignore Crypto Anymore

1. Make your financial portfolio diverse. The traditional ways of spreading risk include stocks, bonds and real estate. But crypto adds another level of diversification. The altcoins that have emerged have become attractive investment assets that have delivered returns that sometimes far outstripped traditional markets.

It’s certainly volatile but crypto can also offer big rewards. Learn how to trade strategically so business leaders can manage risk while capturing market swings.

2. Keep up with Financial Trends Digital currencies are shaking up industries outside finance. From supply chain management with blockchain to retailers accepting cryptocurrency payments, the global shift towards decentralized finance (DeFi) is already happening. As a business leader, you understand crypto trading so you can invest in promising blockchain startups, accept crypto payments in your business model, or just keep up with a tech-driven market.

3. A hedge against inflation and economic uncertainty: Traditional currencies are susceptible to inflation and geopolitical shocks. Many see crypto – particularly assets like Bitcoin – as a hedge against fiat currency devaluation. A large cash position can be converted into crypto, protecting businesses against economic downturns.

How Business Leaders Should Trade Crypto

1. Be Prepared to Dive in First Understand the Basics Before you dive in. These are basic business principles any leader should know:

* Blockchain: Underlying technology is behind cryptocurrencies. Imagine it as a public, inert ledger of all transactions.

* Bitcoin 1and1 Altcoins: Of course, the most popular is Bitcoin, but there are thousands of other (altcoins) available for various uses and markets.

* Exchanges: Exchange platforms for buying and selling cryptocurrencies are available. Examples are Binance / Coinbase / MEXC.

* Wallets: Tools for storing your crypto. Options include hot wallets connected to the internet and cold wallets offline.

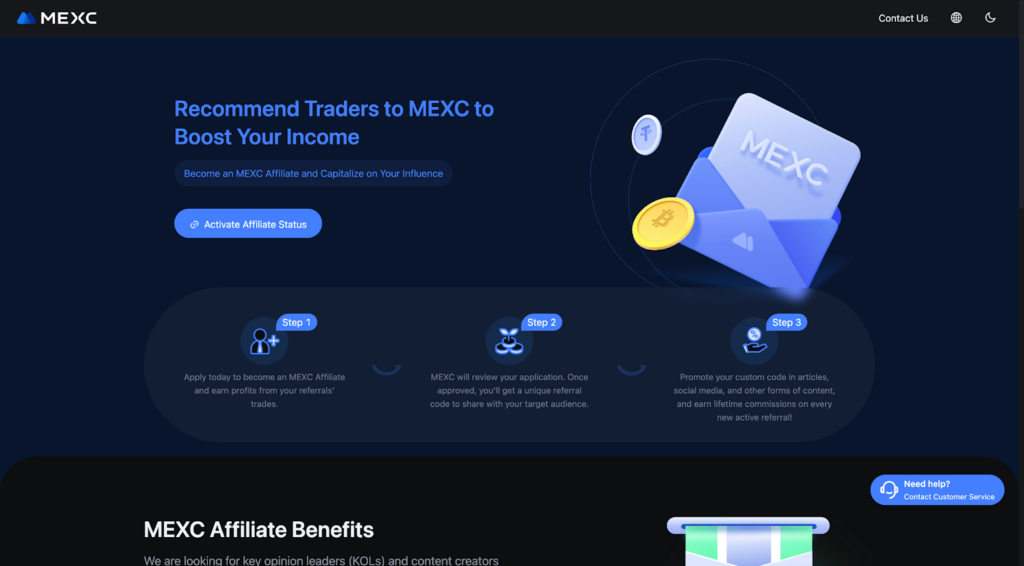

2. Pick the Right Exchange Not all crypto exchanges are created equally. Things like security, transaction fees, available cryptocurrencies and user experience may differ widely between platforms. MEXC boasts large coin listings, high liquidity & easy to use interface – a good choice for both new and experienced traders.

Look for referral codes that offer bonuses or trading fee discounts for new traders. Using a MEXC exchange referral code for example can get you immediate savings or bonus credits when you first trade.

3. Start Small & Practice Risk Management The crypto market is volatile. The other day Bitcoin explodes. One minute it’s dipping. Start small and never invest money you cannot afford to lose – that’s why. For business leaders used to calculated risks, this part should be familiar.

Start small — just a little — to get used to the market rhythms. Most exchanges let you practice without using real money via demo accounts or paper trading features.

4. Use Tools & Data for Smarter trading Crypto Trading is about strategy – not luck. Several exchanges – including MEXC – provide advanced trading tools, market analytics and real time data to help you make better decisions. Business leaders also can leverage automated trading bots, algorithmic trading and portfolio management tools.

Why Crypto Knowledge Gives Business Leaders an Edge

1. Attract New Customer Segments: As more people embrace cryptocurrency, businesses that accept digital payments may appeal to a new crypto enthusiast base. Learning how crypto works helps business leaders decide whether to adopt it in their payment systems or loyalty programs.

2. Building Resilience Against Market Fluctuations: Understanding Crypto is More Than Trading – It’s About Navigating in an increasingly decentralized finance world. Business that adapt early will be more resilient to economic disruptions and better positioned to profit from emerging trends.

3. From NFTs (non-fungible tokens) to decentralized finance (DeFi) platforms, the crypto space offers many avenues for innovation and Investment. Those with basic business understanding might see opportunities before they become mainstream.